A Franklin Circuit Court judge granted a partial judgment in favor of plaintiffs who claim the University of Kentucky’s hospital system used the state Department of Revenue to bypass due process and collect inflated medical debts.

Parties to the case asked Judge Thomas Wingate to rule on threshold issues before the trial continues. In the Aug. 15 ruling, Wingate wrote that “the Department of Revenue improperly collected debts of UK HealthCare using impermissible means to collect unliquidated sums.”

The University of Kentucky until recently tapped into the revenue department to collect its debts. The state added interest and a 25% collection fee and levied bank accounts and wages, intercepted tax refunds and placed liens on property to collect.

State data KyCIR obtained in 2020 showed the revenue department had collected $76 million from UK HealthCare patients since 2009.

Earlier this year, KyCIR reported on documents made public during another lawsuit in federal court that showed the Department of Revenue kept collecting medical debt for the university even after internally acknowledging due process violations.

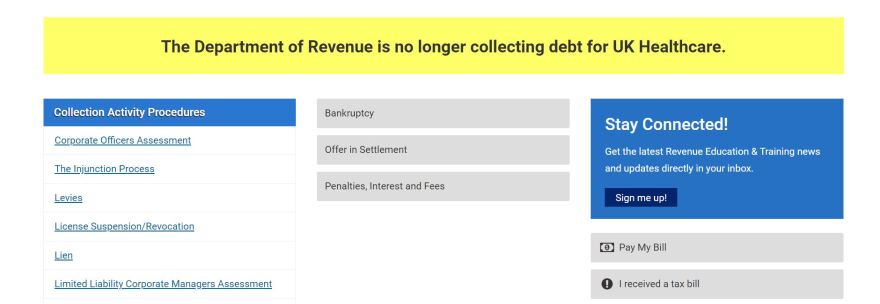

Shortly after that story was published, the revenue department quietly added a notice to its websiteindicating it was no longer collecting medical debt for the University of Kentucky, and the legislature passed tax reforms in April that included language barring the department from collecting consumer medical debt.

“From our perspective, those are thrilling developments because we always thought that method of collection was abusive,” said Ben Carter, an attorney with the Kentucky Equal Justice Center who is representing the plaintiffs in the federal lawsuit. “It was unconstitutional in that it didn’t give people a fair opportunity to dispute the debt, and then used the awesome power of the state to collect the debt in unfair ways.”

The Department of Revenue did not respond to a request for comment.

The lawsuit in Franklin Circuit Court was first filed in 2018 on behalf of Amelia Long and five other plaintiffs.

Long visited a University of Kentucky health care provider for treatment in 2012, assuming she was covered by the state’s Medicaid program or the hospital’s own financial aid program, according to an amended complaint filed in 2019. Long says she never received any bills or communication from the hospital stating the treatment was not covered by financial assistance. She first learned about the debt in 2016 when the Department of Revenue intercepted part of her paycheck from working as a veterinarian technician in Lexington, according to the complaint.

The complaint says Long entered into a payment plan with the department, even though she believed she shouldn’t owe any money to the hospital. She stopped working when she became pregnant in 2016. The revenue department took the entire balance of her bank account on Feb. 23, 2017, the day after her baby was born, according to the complaint. As of April 2018, the state had collected at least $5,000 from Long through levies, intercepted tax refunds or direct payments.

The plaintiffs are represented by attorney Doug Richards, who said the collection process violated patients’ constitutional rights to due process.

One former plaintiff, Sherrie Turner, died in 2020, three years after the Department of Revenue placed a $48,000 lien on her home in Cold Spring, Ky., for debts she was in the process of disputing.

Even though the revenue department has stopped collecting debts for the university, the lien on Turner’s home remains. “While they're claiming to have stopped all these collection efforts, and there's now a state law saying that they can't collect these health care debts, they still have a lien on her property,” Richards said. “And her husband wants to sell the property and move on. But he can't do it because of the lien.”

The ruling from Wingate is “not a final ruling, but it's certainly a sign of things to come,” Richards said.

Both sides filed briefs on so-called threshold issues, or issues that needed to be resolved before the case could continue. Among those threshold issues were: Was the university legally entitled to use the revenue department to collect its debts? And could defendants be sued for their debt collection practices, or were they protected by sovereign immunity?

Both sides filed their briefs and Wingate ruled on Aug. 15.

The statutes the university points towards to justify its debt collection practices are narrow, Wingate wrote, and don’t allow for the collection of consumer debts. Kentucky law allows the revenue department to use its debt collection powers to claw back debts resulting from improper payments from the state, either by accident or by fraud.

“The statutes do not allow an agency to refer its ordinary trade accounts to the Department of Revenue,” Wingate wrote.

The retired state lawmaker who wrote the statute in question told KyCIR back in 2020 that the law was never meant to allow for consumer debt collection of the kind the university was pursuing.

Wingate also wrote that the university improperly referred debts to the revenue department for collection before appeals and legal actions were exhausted, meaning patients didn’t have a chance to challenge the veracity of their debt.

Wingate also ruled that the defendants are not entitled to sovereign immunity, which protects government entities from legal challenges.

“The idea of (sovereign immunity) was, the king is never wrong. And you can't sue the king,” Richards said. “They are saying that a state agency can take money from people illegally, and they cannot be held accountable for it.”

A spokesperson for the University of Kentucky referred KyCIR to August 22 court filings where lawyers for the defendants ask Wingate to reconsider his decision.

In that filing, the defendants argue Wingate’s conclusion that the Department of Revenue improperly collected debts is “premature and overbroad.” There are other issues to be briefed and argued, the filing claims, such as whether the plaintiffs failed to request administrative remedies or procedures available. The filing also argues that the administrative debt collection process serves as an alternative to collection lawsuits filed in court. Wingate’s ruling would change the way Kentucky uses administrative proceedings, defendants argue.

Now that threshold issues have been decided, unless the judge reconsiders his ruling, the case will proceed to decide issues such as whether the university is required to repay plaintiffs what has been collected, or whether the university can sue the plaintiffs to collect unpaid debt without involving the revenue department.

The next hearing for the case is scheduled Sept. 7.